Property Tax In Aiken County Sc . The aiken county website allows users to search for and pay their taxes online. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center.

from medium.com

Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. The aiken county website allows users to search for and pay their taxes online.

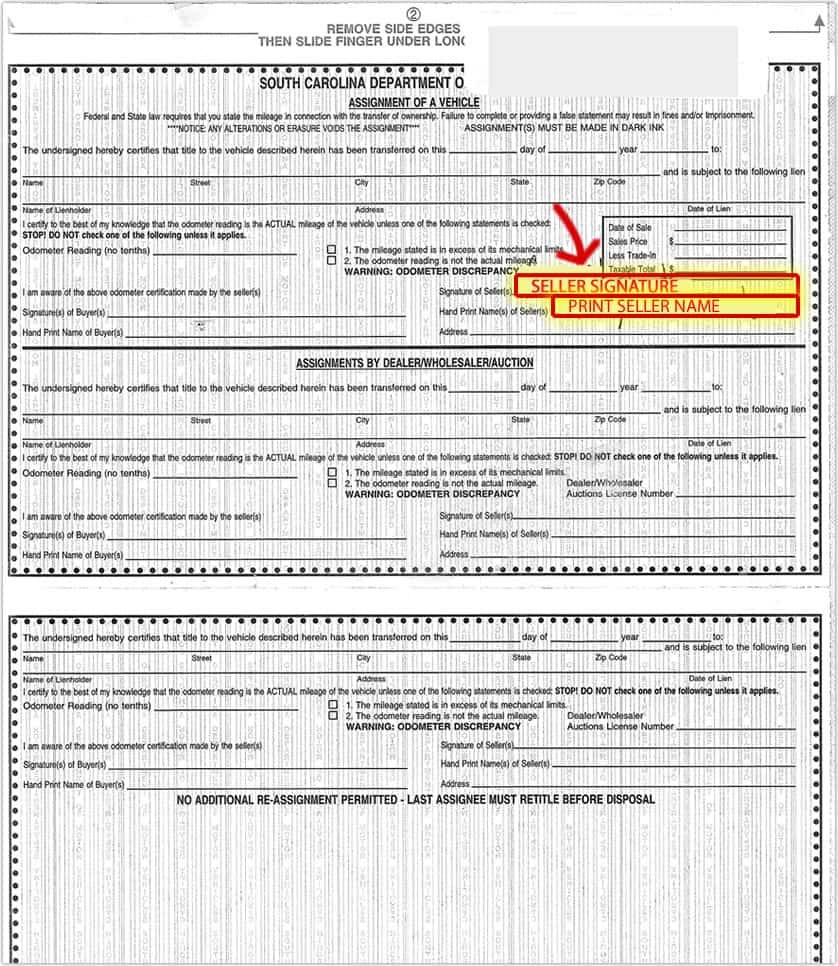

SC Vehicle Property Tax Everything You Need to Know by Gene Smith

Property Tax In Aiken County Sc The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. The aiken county website allows users to search for and pay their taxes online. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000.

From www.landwatch.com

Aiken, Aiken County, SC Undeveloped Land, Homesites for sale Property Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. The aiken county website allows users to search for and pay their taxes online. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. The median property tax in aiken county,. Property Tax In Aiken County Sc.

From www.niche.com

2020 Safe Places to Live in Aiken County, SC Niche Property Tax In Aiken County Sc The aiken county website allows users to search for and pay their taxes online. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. Aiken county property owners may. Property Tax In Aiken County Sc.

From www.aikencountysc.gov

Aiken County Government Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. Aiken county property owners may now pay vehicle and property taxes securely online using the county's. Property Tax In Aiken County Sc.

From www.mapsofworld.com

Aiken County Map, South Carolina Property Tax In Aiken County Sc The aiken county website allows users to search for and pay their taxes online. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. Aiken county property owners may. Property Tax In Aiken County Sc.

From www.stayz.com.au

Aiken County, US holiday from AU 75/night Stayz Property Tax In Aiken County Sc The aiken county website allows users to search for and pay their taxes online. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The median property tax in aiken county, south. Property Tax In Aiken County Sc.

From www.aiophotoz.com

Aiken Sc Wall Map Images and Photos finder Property Tax In Aiken County Sc The aiken county website allows users to search for and pay their taxes online. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The scope of work performed by the aiken. Property Tax In Aiken County Sc.

From www.aikencountysc.gov

Aiken County Government Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. The aiken. Property Tax In Aiken County Sc.

From www.postandcourier.com

Lower Aiken County millage rate won't mean lower property tax bills for Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov. Property Tax In Aiken County Sc.

From mungfali.com

Aiken South Carolina County Map Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina. Property Tax In Aiken County Sc.

From thevillageatwoodside.com

Aiken, SC Low Cost of Living and Tax Friendliness The Village at Property Tax In Aiken County Sc Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. The aiken county website allows users to search for and pay their taxes online. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. Aiken county property. Property Tax In Aiken County Sc.

From www.scpictureproject.org

Aiken County Government Center SC Picture Project Property Tax In Aiken County Sc The aiken county website allows users to search for and pay their taxes online. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The median property tax in aiken county,. Property Tax In Aiken County Sc.

From www.saturatesouthcarolina.org

COUNTY HOME AIKEN COUNTY Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services center. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. The aiken county website allows users to search for and pay their taxes online. The median. Property Tax In Aiken County Sc.

From www.scdigitaldrive.com

Aiken County (202107) Areas of Need SC Digital Drive Property Tax In Aiken County Sc The aiken county website allows users to search for and pay their taxes online. Our aiken county property tax calculator can estimate your property taxes based on similar properties, and show you how. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. Aiken county property owners may now pay vehicle. Property Tax In Aiken County Sc.

From www.countiesmap.com

Aiken County Sc Tax Maps Property Tax In Aiken County Sc The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. Aiken county property owners may now pay vehicle and property taxes securely online using. Property Tax In Aiken County Sc.

From medium.com

SC Vehicle Property Tax Everything You Need to Know by Gene Smith Property Tax In Aiken County Sc The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. The aiken county website allows users to search for and pay their taxes online.. Property Tax In Aiken County Sc.

From www.postandcourier.com

City program can help Aiken seniors lower or eliminate their property Property Tax In Aiken County Sc The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The aiken county website allows users to search for and pay their taxes online. The median property. Property Tax In Aiken County Sc.

From www.sciway.net

Aiken Places Cities, Towns, Communities near Aiken, South Carolina Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The median property tax in aiken county, south carolina is $588 per year for a home worth the median value of $119,000. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina. Property Tax In Aiken County Sc.

From www.lamarcounty.us

Aiken County Tax Office In North Augusta Lamarcounty.us Property Tax In Aiken County Sc Aiken county property owners may now pay vehicle and property taxes securely online using the county's new egov services. The scope of work performed by the aiken county assessor is based on the requirements of the south carolina code of laws, south carolina. The aiken county website allows users to search for and pay their taxes online. Aiken county property. Property Tax In Aiken County Sc.